Table of Contents

Characteristics of branch offices in Hungary

The regulation of the Branch Offices and Commercial Representative Offices Act CXXII of 1997 must be respected during the commercial activities carried by the branches of foreign companies. The main difference between a branch and a legal entity is that for all the actions of the branch the foreign company is responsible and only certain activities can be performed by branches without the approval of the parent company. Actions like buying assets or shares from another company or branch must first receive the approval of the foreign company’s representative.

Parent companies must provide the necessary assets to the branches in order to perform any activities. When branches are requested to provide lists with assets, the properties of the foreign company are also included. Every year, the financial accounts of branches established in Hungary must be submitted along with the balance sheets of the parent companies.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Hungarian law (Hungarian Accounting Act, Companies Act, Foreign Investment Act, etc.) |

|

Best Used For |

implementing the same business model of the parent company / less accounting obligations / suitable for the financial industry (banking, insurance) |

|

Minimum share capital (YES/NO) |

Not required |

| Time frame for the incorporation (approx.) |

Obtaining governmental approval: one week / the overall setting up: 3-4 weeks |

| Management (Local/Foreign) | A local branch manager has to be appointed (no residency requirements) |

| Legal representative required (YES/NO) |

Yes (the branch manager) |

| Local bank account (YES/NO) |

Yes, it is required for all companies in Hungary, as a part of the incorporation process. |

| Independence from the parent company | Although the branch is registered separately from the parent company, it is a unit that is dependent on the parent company abroad. |

| Liability of the parent company | Fully liable for the debts of the branch |

| Corporate tax rate | 9% |

| Possibility of hiring local staff (YES/NO) | Yes |

| Documents required for the registration |

– the articles of association of the parent company, – its registration certificate, – the decision to open a branch, – the standard application form, – information on the registered address in Hungary, – the list of directors, – information on the person appointed as the representative, specimen signatures. |

|

Institution in charge with the registration |

The procedure to establish a branch in Hungary is completed through the Hungarian Court of Registration. |

|

Tax registration obligations |

The branch is required to register for taxation with the National Tax and Customs Administration and to comply with the tax reporting procedures applicable by the law. |

| Tax reporting | The branch has to maintain its books of accounts and prepare financial statements in accordance with the accounting formalities available in Hungary. |

| Taxes charged to a Hungarian branch |

A branch is liable to the payment of the corporate tax, value added tax, employment taxes and other taxes imposed to Hungarian legal entity (the main difference being that the taxes are calculated only to the income obtained from operations carried out here, not on the global income of the company). |

| Audit obligations (yes/no) |

Yes |

| Audit exemptions |

Investors can establish a branch in Hungary and not be required to completed audit formalities only when the headquarters of the parent company is registered in an EU member state. |

| When can a branch start its activity? |

Only after the Hungarian Court of Registration issues all the documentation and certificates. |

| Fees for company registration for a branch |

HUF 50,000 |

| Tax number required (yes/no) | Yes |

| Accounting legislation applicable to foreign branches |

The Hungarian Act on Accounting |

| Termination of business operations of a branch |

The parent company is required to address Hungarian authorities, by submitting a decision of termination of the Hungarian branch. The decision must be submitted within 60 days since the date when the decision was taken. The branch will be deleted from registers if the company doesnt have any outstanding debts to pay. |

| Institution in charge with the liquidation of a branch |

The Hungarian Court of Registration |

| Notary proceedings (yes/no) |

Yes |

| Ways in which our team can help in registering a branch |

Our consultants can help you establish a branch in Hungary, can put you in contact with a local notary public and can provide legal representation throughout all stages of registration. Likewise, our team can offer professional post-incorporation services (tax consultancy, accounting, etc.) or if you want/need to close down the business. |

A major advantage of opening a branch in Hungary is that it is not necessary to subscribe a minimum share capital. If the company is located outside EEA member states or no special treaties are signed, a permit must be received before registering a branch. Our team of specialists in Hungarian company formation can present more details on other requirements applicable to branch offices. We can also help you if you are interested in setting up a branch office in Singapore, through our Singapore partners.

If the parent company enters the liquidation process and its assets must be seized, the assets of the branch are also subject to enforcement. The procedure is the same if the branch is subject to enforcement: the parent company’s assets may be seized in order to cover the branch’s debts. If you choose to invest in Hungary by expanding your company here, our team of local incorporation agents is at your disposal.

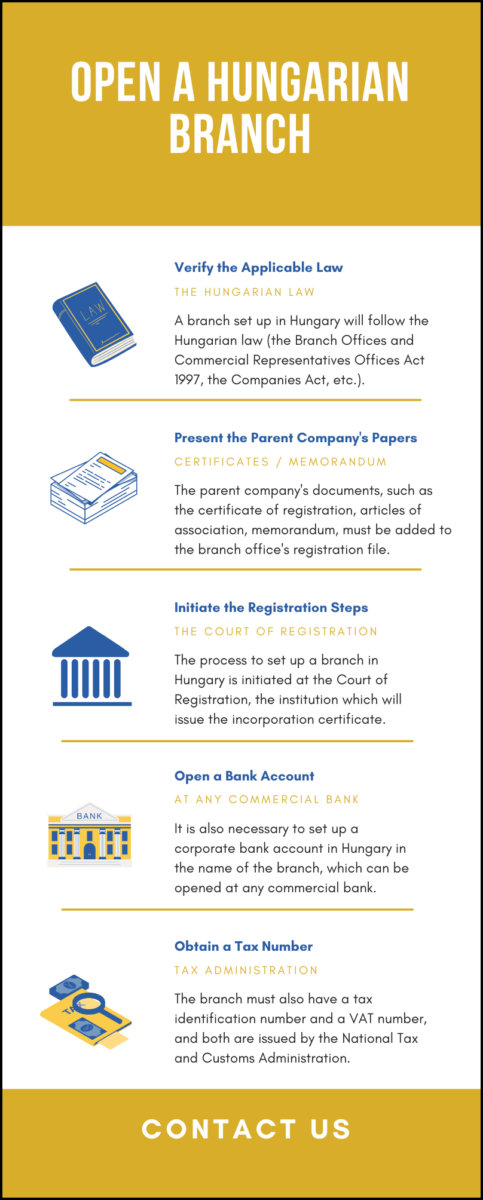

The procedure of registering a branch in Hungary in 2024

Before starting to operate in Hungary, the company must register with the Court of Registration. Unlike local companies, foreign companies must present many more documents at registration. A dossier must be prepared and it must contain the documents presented below; more information on these papers can be provided by our team of consultants in company registration in Hungary:

- • the standard application and the certificate of registration of the foreign company;

- • the certificate of the share capital, as well as the memorandum and the articles of association of the parent company;

- • the decision of opening a branch and a list with the directors and the secretary, as well as the registered address of the parent company;

- • the name of the branch and its registered address and the name of the representative appointed with power of attorney;

- • the specimen of signature for the person responsible with the branch’s decisions.

The Court of Registration will issue a certificate of registration, necessary to register the branch for taxes and VAT. Also, if the branch has any employees, the social services must be announced regarding the incorporation of the branch. The process of opening a branch in Hungary doesn’t take longer than five working days if all the documents are in good order and are deposited on time. The timeframe is short compared to other European countries, such as Spain, where opening a branch can take approx. 6 weeks and starting a Spanish LLC – up to 4 weeks.

As mentioned above, a branch must register for VAT as well. In 2024, the standard VAT is 27%, but reduced rates of 18%, 5% and 0% are available. VAT payers must submit VAT returns on a monthly, quarterly and yearly basis.

Concerning VAT, it must also be noted that if a company completes transactions with other EU companies, Intrastat reports must be submitted as well (there are 2 thresholds available for 2024 – HUF 150 million and HUF 270 million).

For more on how to open a branch in Hungary, please watch the video below:

What are the tax regulations for Hungarian branches in 2024?

Given the fact that a local or foreign company will set up the branch office with the purpose of developing a commercial activity, this will create certain tax obligations for this company type. Foreign businessmen who want to open a Hungarian company should be aware that the branch office is liable to local taxes in accordance with the accounting regulations available in Hungary.

For this purpose, one should become familiarized with the regulations prescribed by the Hungarian Accounting Act, which presents the tax obligations imposed to branch offices set up here by foreign companies. A detailed presentation on this law can be provided by our team of consultants in company formation in Hungary as well, who can also provide you with accounting services. In case you need legal services in another country, for example in India, we recommend our partner law firm – Lawyer-India.com. For company formation services in another jurisdiction, for example in Brazil, we invite you to get in touch with our partners – CompanyFormationBrazil.com.

From a taxation view point, the branch office will be treated as a permanent establishment in Hungary, which means that the entity will only be liable to local taxes for the income obtained in a financial year from the business operations developed in this country.

The branch office set up here must also register with the National Tax and Customs Administration, an institution which will issue a tax identification number. Being registered for taxation purposes means that the company has to maintain certain accounting documents as per the applicable legislation.

Here, those who open a company in Hungary (as a corporate body or as a branch office) are obligated to maintain double-entry books and during the financial year, they have the obligation to complete and publish various accounting documents, such as the annual accounts or the simplified annual accounts.

Besides these, companies can also prepare consolidated annual financial statements. These include the profit and loss account statement, the balance sheet and the supplementary notes. These documents must be submitted with the local authorities by the companies obligated to prepare them.

Of course, our accountants in Hungary can prepare the documents and submit them on behalf of the company.

A branch office in Hungary is also liable to the payment of the corporate income tax, which is calculated based only on the overall income obtained from the activities carried out here. At the moment, the corporate income tax applicable here is charged at the rate of 9%. We invite investors to request in-depth information on the current taxes applied to branch offices from our specialists in company registration in Hungary, who can help you throughout the entire tax registration procedure, as well as through the process of opening the branch office.

From a tax point of view, a branch office in Hungary is considered a permanent establishment of a foreign company. This is why the branch will only be taxed for its income obtained in Hungary, but it will follow the tax system applicable in this country. For 2024, branch offices are liable for the payment of corporate tax charged at a rate of 9%. They are also liable to other local taxes, which can be presented by our team of specialists in company formation, who can help you register a Hungarian branch in 2024.

Please mind that if you want to open a branch in Hungary in 2024 and if the headquarters of the company is situated in a country with which Hungary did not sign a tax treaty, additional taxes can apply.

A novelty brought in 2023, which has been maintained in 2024 as well, is addressed to those who want to set up a branch that will develop online sports services on the Hungarian market.

Thus, all companies that will set up a branch must have a minimum of 5 years of business activity in this sector in an EEA country. The law stipulates that those who will open a branch in 2024 as online sports operators will have to deposit a capital of EUR 2,5 million.

The rules for 2024 have been established under the 2022/66/HU and 2022/67/HU laws. The law states that these type of companies are required to register a representative. If you want to set up a branch in 2024 in this industry you must know that the representative has to be a Hungarian citizen who is currently residing in Hungary. Additionally, the person must have a suitable education background in law or economics.

What is the data on foreign companies in Hungary?

Typically, foreign investors prefer to set up here a limited liability company or a joint stock company. However, common ways to open a company in Hungary as a foreign investor are represented by the branch office and the subsidiary, these being types of entities that are regulated by the national commercial law for the purpose of expanding a local or a foreign business on the local market.

Foreign businessmen have to know that Hungary is one of the most important recipients of foreign direct investments in the European Union (EU); foreign businesses or foreign-owned companies operating here can be found in most of the economic sectors that represent the Hungarian economy, the following data being available:

- • in 2016, the foreign controlled companies in Hungary accounted for 51,4% of the value added in the local economy (measured as businesses operating in the non-financial sectors);

- • this meant that foreign owned companies in Hungary had the highest value in the local economy of a EU country, Hungary being the 1st economy in this sense;

- • the EU average for the same index stood in 2016 at only 25%;

- • in 2019, the foreign direct investment stock accounted for $97,841 million in Hungary, an increase compared to 2018, when the value was of $95,787 million;

- • the value of greenfield investments, in which a foreign company starts an investment project from ground up, also increased in 2019 to $7,515 million, from $4,894 million in 2018, according to the latest data of the United Nations Conference on Trade and Development (UNCTAD).

The country’s main investors are from EU countries, with Germany as the main investor (accounting for 13% of all the investments), the Netherlands (10,3%) and Luxembourg (10,1%). Foreign investors interested in Hungarian company formation prefer to invest in the manufacturing sector (accounting for 38% of all the investments).

If you need more details in regards to establishing or managing branches in Hungary, please feel free to contact our company formation specialists. Our team of specialists can help you in all the steps related to the process of company incorporation in Hungary; you can also rely on our specialists for tax registration or for obtaining various permits and licenses necessary for certain business activities.