Table of Contents

Reasons for establishing a subsidiary in Hungary

Subsidiaries are forms of legal entities opened by foreign companies in order to perform commercial activities not necessarily in the same field as the foreign company. The main characteristics of a subsidiary in Hungary and the process of opening this type of office are presented in our table below.

Please know that if you will purchase a property for commercial purposes for your subsidiary, you are required to pay the building tax. The entity who is a property owner on 1st of January is required to pay tax for the respective financial year (if you will purchase a property in January 2024, you will need to pay building tax for the current financial year).

| Quick Facts | |

|---|---|

| Definition of a subsidiary | A subsidiary is a sub-division of a parent company operating abroad, which is independent from the parent company (separate legal personality) and which is set up following the national incorporation rules available for companies in the country where it develops its operations. |

|

The main characteristics of a subsidiary |

– set up as a legal entity, – independent from the parent company, – the parent company is the main shareholder of the legal entity operating in Hungary, – subjected to taxation in Hungary. |

|

Law applicable to subsidiaries |

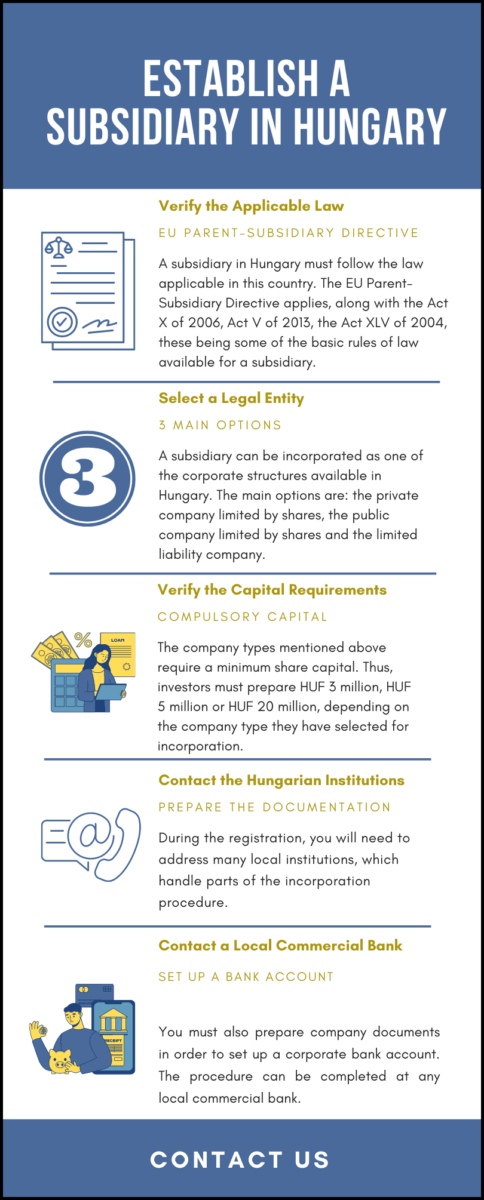

– Act X of 2006, – Act V of 2013, – Act XLV of 2004, – EU Parent-Subsidiary Directive. |

| Documents necessary to establish a subsidiary in Hungary |

– the incorporation documents of the parent company (articles of association, certificate of registration issued by the authorities of the country where the parent operates), – the decision to set up a subsidiary, the Certificate of Good Standing of the parent company, – the identity documents of the persons representing the company, – the power of attorney (where applicable), documents translated into Hungarian, – registration forms, etc. |

| Capital requirements (yes/no) |

Yes |

| Company types for subsidiaries |

– public limited liability compay, – private limited liability company. |

| Registration institutions |

– the Hungarian Registration Court, – Chamber of Commerce and Industry, – National Office for Health Insurance, – the Hungarian Ministry of Economy. |

| Duration of the process to establish a subsidiary in Hungary |

Approximately 15 days. It can start its operations in 5 days after registering for social security. |

| Taxes imposed to Hungarian subsidiaries |

Hungarian subsidiaries are liable to paying all the taxes charged to local companies (corporate income tax, VAT, employment taxes, withholding taxes, etc.) |

| Notary public procedures (yes/no) | Yes |

| EU Parent-Subsidiary Directive applicable in Hungary (yes/no) |

Yes |

| Minimum capital |

HUF 3 million (limited liability company)/ HUF 20 milion (public company)/ HUF 5 million (private limited company) |

| Parties involved in the registration process |

– the representatives of the Hungarian institutions, – the public notary, – the company’s appointed representatives, – our consultants in company formation in Hungary, – lawyers. |

| Main incorporation steps |

– choosing the suitable legal entity, – preparing the documentation, – register with the local authorities, – register for taxation and social security, – open a corporate bank account and submit the necessary capital, – set up a business address, – obtain a tax identification number. |

| Incorporation services offered by our consultants | Our team can provide legal assistance in any of the steps mentioned above which are compulsory in order to establish a subsidiary in Hungary and can offer post-incorporation services as well, such as tax advice, tax compliance, accounting services. |

| Registration obligations for taxation | A subsidiary is required to apply for a VAT number and a Tax Identification Number during the registration formalities, and this is completed with the National Tax and Customs Administration. |

|

Best Used For |

Investors can establish a subsidiary in Hungary if they want to set up a business that has the following characteristics: – independence from the parent company, – diversification of the business activities, – access to tax benefits offered to businesses in Hungary (the subsidiary is treated as a Hungarian incorporated business). |

|

Publication fee |

Companies in Hungary must pay a publication fee, charged at HUF 5,000, through which they publicly announce the incorporation of the business (exemptions are granted based on the legal entities selected for registration). |

| Penalties | Please mind that if you want to establish a subsidiary in Hungary will be asked to pay penalties if you do not comply with the applicable law/reporting in due time. The fees vary from HUF 50,000 to HUF 900,000. |

| Management (Local/Foreign) |

Foreign management is allowed. |

| Legal representative requirements |

It is necessary to appoint a legal representative. |

| Local bank account setup procedure |

The subsidiary is required to set up a corporate bank account at a commercial bank in Hungary. The procedure takes around 2 weeks and the company’s representatives have to provide all the incorporation documentation (of the parent company and the documents attesting the registration of the subsidiary). |

| Independence from the parent company |

The subsidiary is an entity that is independent from the parent company, it has its own legal personality, but the parent company is the main investor (owning at least 50% of the subsidiary’s shares). |

| Liability of the parent company |

Limited to the amount invested. |

| Corporate tax rate | 9% |

| Annual accounts filing requirements |

If you will establish a subsidiary in Hungary as a Kft., Zrt., or Nyrt., tax filing and accounting reporting obligations will arise. The annual reports must be concluded as per the Hungarian tax and accounting law and in accordance with the: – yearly turnover, – number of employees, – the corporate assets’ value. |

| Possibility of hiring local staff (YES/NO) |

Yes |

| Travel requirements for incorporating branch/subsidiary (YES/NO) |

No |

| Number of double tax treaties signed by Hungary |

More than 80 treaties. |

| Access to investment incentives | Qualifying foreign businesses can obtain investment incentives through the Hungarian Investment and Promotion Agency. |

A series of treaties signed by Hungary that have as result the exemption or lower withholding taxes have a great importance as to why foreign companies choose this location to open subsidiaries. Our team of consultants in company registration in Hungary can present the main treaties available in this sense.

Legislation for foreign investors in Hungary

For example, Hungary has adopted the EU Parent-Subsidiary Directive which allows the exemption from the withholding tax on dividends paid to a company based in a EU country. If the company is not situated in the EU, it can still have privileges granted by the many double tax treaties signed by Hungary across the years (more than 60). These treaties provide an exemption on corporate taxes or their refund in Hungary and lower or exempt withholding taxes on dividends, interests and royalties paid to a treaty country.

Besides the above mentioned, rules regulating the incorporation and the activity of a subsidiary can derive from other national laws, such as: the Act XLV of 2004, the Act CCXXXII, the Act X of 2006 and the Act V of 2013. Our team of consultants in company formation in Hungary can advise on the rules that you have to follow, based on the legal entity that your Hungarian subsidiary will have.

What is the data on foreign companies in Hungary?

Hungary is the recipient of numerous companies with foreign capital; although the largest share of companies is represented by Hungarian based entities, as it is the case anywhere else in the world, foreign companies have a major importance with regards to the added value they create in the local economy, in terms of investment levels, capital, employment and others. Below, our consultants in company formation in Hungary have prepared a short description of the Hungarian companies and foreign companies:

- • in 2019, there were 118,835 active companies operating in Hungary, according to the data of the Hungarian Central Statistical Office, which represents the largest value registered in the period of 2014-2019;

- • the largest number of foreign companies, by country of origin, is represented by German companies, which, in 2020, accounted for 4,124 businesses;

- • the next top investors were Ukraine (3,975 companies), Austria (3,754 companies), Slovakia (2,839 companies) and Romania (2,471 companies);

- • in 2018, the sectors with the largest share of foreign investments was the financial and insurance sector (accounting for 52,3% of all investments) and the manufacturing industry (21,1%);

- • other attractive industries were the wholesale and retail (5,8%) and real estate (4,6%).

Characteristics of subsidiaries in Hungary in 2024

A Hungarian subsidiary can be registered only as a corporate body, so it has to take the form of a company that has its own, distinctive legal personality. In most of the cases, investors will choose a joint stock company or the limited liability company, but, in practice, the latter is the most common way to start a subsidiary in Hungary.

A public company limited by shares (Nyrt.) has a capital requirement of HUF 20 million, and in 2024, the company’s capital has been maintained as such; the capital has to be paid and this can be done in cash or kind. The company’s members are responsible for the company’s debts only to the level of their capital participation. The shares are freely transferable even to the public, especially through the Stock Exchange Market.

A private company limited by shares (Zrt.) established in Hungary is founded based on a share capital of at least HUF 5 million and just like in the case of the previously described company, the liability of its members it’s limited by the contribution to the capital. The main difference is that the shares of this type of company cannot be transferred to the public.

However, those who want to register a subsidiary in Hungary in 2024 as a limited liability company benefit from the rules applicable to this company type, which means that the investors will have limited liability against company debts. The same rules apply when opening a subsidiary as a public limited company in 2024, with the main difference that this company type is recommended for large businesses. Our team of consultants in company registration in Hungary can provide information of advantages of selecting either one of these Hungarian companies in 2024.

If you want to open a business in Hungary in 2024, please mind that the private limited company can be later changed into a public limited company, if the business will be successful and if the characteristics of the private company will no longer suit the needs of the company.

Investors can also set up a limited liability company (Kft.), which is founded with a capital of HUF 3 million.

What are the documents for subsidiary registration in Hungary?

During the process of company formation in Hungary, all businessmen have to prepare a set of documents regardless of the company type they choose to register. This is also the case of those who will register a subsidiary. For its registration, investors will have to prepare the articles of association and the memorandum of the parent company and the Certificate of Good Standing of the parent company, all documents being issued in the country where parent company is registered.

Given that the documents will be written in a foreign language, the investors should also take the necessary steps in order to provide an official translation of such documents into the Hungarian language. Another necessary document when opening a company in Hungary as a subsidiary is the decision of the parent company, through which it establishes that it will set up a subsidiary in a foreign country.

Investors will also have to sign a power of attorney and provide samples of specimen signatures of the company’s representatives. A large part of the documents, such as the parent company’s certificate and incorporation documents, as well as the power of attorney, have to be processed at a public notary in Hungary, who is the sole entity in charge with notarizing or providing official translations of such documents.

The registration of a subsidiary in Hungary in 2024

The process of registration of a subsidiary in Hungary begins with hiring a lawyer to prepare the company’s foundation deeds and articles of association. The decision of opening a subsidiary provided by the parent company must also be seen by the attorney. At least half of the minimum share capital must be deposited in a bank account and a certificate of deposit must be released.

The registration of a Hungarian subsidiary continues with the electronic submission of the company’s documents (certificate of deposit, the articles of association, the foundation deeds and the decision of opening of the subsidiary) at the Registration Court. You can find out more details on this subject from our team of specialists in company registration in Hungary.

Investors who want to set up a subsidiary in 2024 must know that the incorporation will take approximately 15 days. This refers to the period of time in which the investors will submit the documents, obtain various certificates and authorizations, and time in which the Hungarian authorities will issue the necessary approvals.

We invite you to watch a short video on how to establish a subsidiary in Hungary:

What are the accounting obligations for a Hungarian subsidiary?

When you open a company in Hungary, given that the company is registered for commercial purposes, it will have numerous tax obligations. This will be reflected in the accounting documents maintained by the company in a financial year, which will show the company’s true financial situation, which will then reflect the level of taxation applicable to the company.

All companies that sell goods and services are generally liable to the payment of the value added tax (VAT) and this means that the company has to obtain a VAT number. Once the company is a VAT payer, certain obligations will appear, such as submitting VAT returns as monthly, quarterly or yearly returns – this depends on the company’s return.

Subsidiaries are VAT payers and they must prepare all the documentation concerning the VAT that is owed to the Hungarian state. The yearly VAT reports must be submitted by 25th of February of the next financial year. This means that, for 2023, companies must submit their yearly VAT reports by 25th February 2024.

VAT is charged at different tax rates, established for specific categories of products and services. In 2024, the VAT rates are 27%, 18%, 5% and 0%. Companies are taxed in accordance with the types of services and products they sell on the Hungarian market.

The company should hire an accountant who will be in charge with maintaining the company’s books or accounts and other accounting documents in accordance with the specifications of the law. An audit can also be required for such companies; our consultants in company registration in Hungary can also provide accounting services.

The accounting procedures applicable to a subsidiary have to be done in accordance with the rules of law of the Accounting Act, which can be detailed by our accountants in Hungary.

The Act prescribes rules and regulations applied to the subsidiary, which is included in the Section 3, Paragraph (2) of the law (definition and the relation with the parent company). The law also mentions the accounting obligations of this structure.

The last step of opening a subsidiary in Hungary is registering for the social security. The process of registration is one of the simplest in Europe, especially because of the recently implemented electronic system. In maximum 5 days from the day when the documents are submitted, the Hungarian company may pursue with the economic activities. Please contact our Hungariancompany formation specialists for more information regarding Hungarian subsidiaries.

Please know that during the registration, you will be asked to pay processing fees. The registration fees vary based on the type of company you will register. In 2024, the fees vary from HUF 50,000 to HUF 100,000.